Nairobi County Governor Johnson Sakaja Saturday announced that he had joined the now famous social media platform, TikTok.

With barely two days of joining the platform, Sakaja has already gained over 206,000 followers as at the time of publishing this article.

Behind the fast growth of his, there is a 20-year-old lady who has been running it since its launch on Saturday.

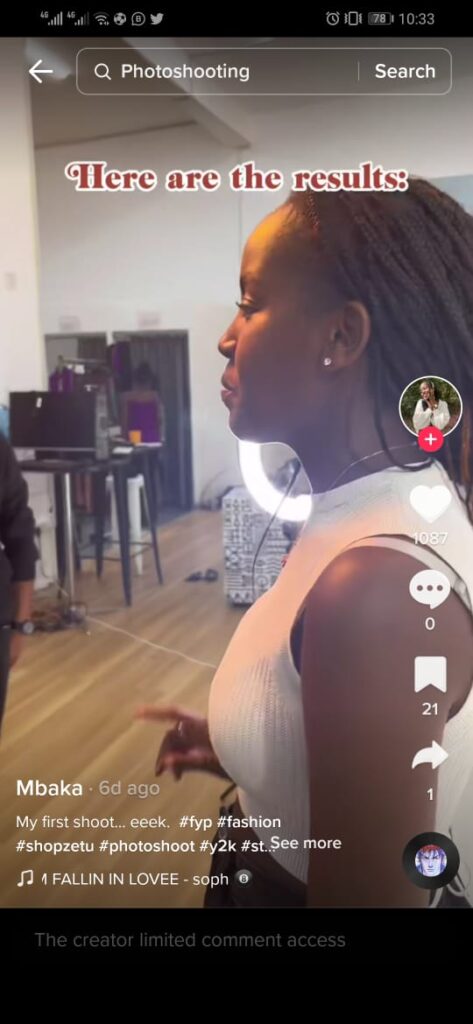

Speaking on Saturday, January 29 while unveiling the account, Governor Sakaja revealed that the 20-year-old content creator Mbaka Wainaina was behind his new TikTok account.

“I can see everyone is asking who is the one person am following, it is my social media manager, follow her as well,” Sakaja announced while introducing her to the public.

Though a famous TikToker, Mbaka came to the limelight during the campaigns ahead of the 2022 general election.

She had been campaigning for Azimio and pushed hard to influence her followers in voting for her fellow woman, NARC Kenya party leader, and Azimio running mate Martha Karua.

She worked closely with Diana Ngao, head of communications, Martha Karua’s secretariat. She is also a co-founder of Girls for Girls Teens.

Mbaka is the only person being followed by Sakaja on TikTok.

Below are some of the photos we picked from her TikTok account.