Detectives deployed to pursue fraudsters in mega gold scams reported across the country have today arraigned a US citizen implicated in a scam involving thousands of kilograms of gold that cost the victim over USD 1.35 million.

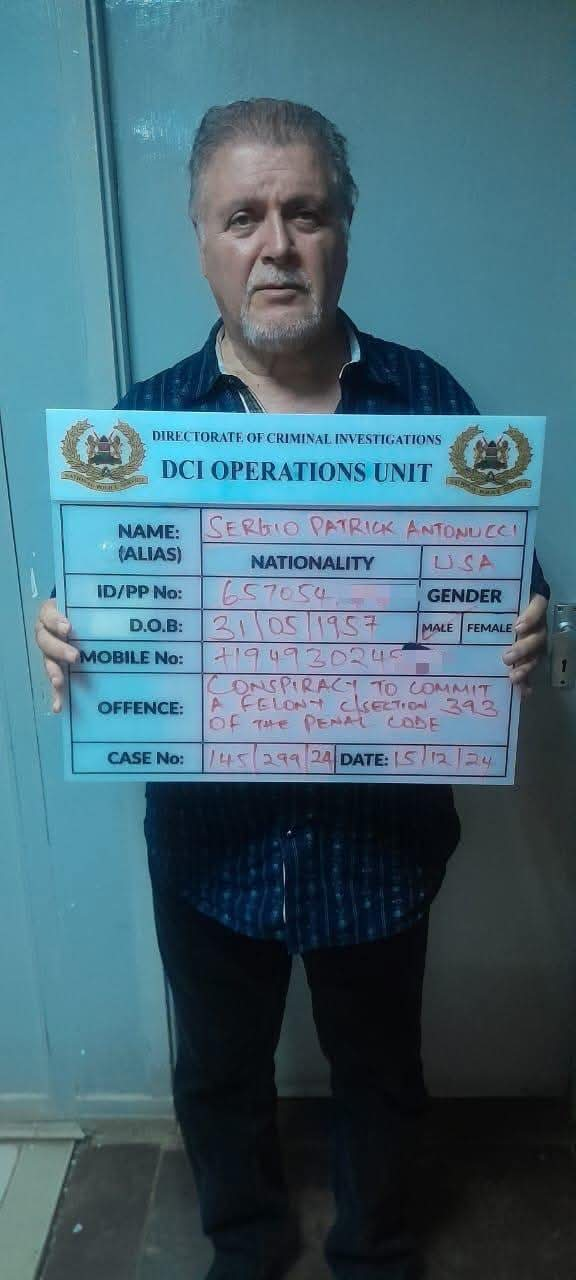

Antonucci Sergio Patrick was arraigned at Milimani Law Courts charged with Conspiracy to commit a felony and Obtaining money by false pretences, following his arrest yesterday after jetting into the country from Dubai.

Establishments made after thorough investigations reveal that Sergio met the complainant sometime in July 2023 in Nevada, Las Vegas, USA introducing himself as a former banker and investor and legal consultant that specialised in conducting business in markets that are considered hostile and complex by the United States standards.

Awed by the profile, the complainant who happens to be a fellow compatriot contracted him (Sergio) to protect his gold transactions in Africa assuming that he was licensed and for this paid him USD 50,000 signing bonus on the 29th August, 2023, followed by a 15,000 US Dollars payment on the 24th of January, 2024 and a further 15,000 US Dollars on February 28, 2024.

In the broad scheme that has also seen a Congolese accomplice (Eric Kalala Mukendi) charged, the victim was made to fly to Nairobi where Sergio introduced him to another American accomplice, Caden Gebhard, whom he presented as an active duty US Soldier with the 19th Special Forces Group. Allegedly, Caden was critical in the business since he had contacts in the region.

It was following the meeting that the complainant was also introduced to the alleged owner of the gold and the licensed exporter at the Four Points by Sheraton Hotel in Hurligham, Nairobi.

Oblivious of his compatriots’ plot to fleece him, the complainant through his company AURUMSIC ONE LLC entered into a Sales and Purchase Agreement with the seller company – AERO Logistics – for the sale of 2820Kg of gold in which he ended up paying an amount of USD 1,271,200 in the said transaction that was executed on diverse dates between 31st March, 2024 and 30th May, 2024.

In the end, no consignment was delivered prompting the matter to be reported to the police.

Today, Antonucci Sergio Patrick was arraigned for plea taking. He pleaded not guilty and was granted a bond of Sh 10 million plus one Kenyan surety. The case will be mentioned on 23rd January, 2025 for pretrial. Meanwhile, more accomplices in the scam are being pursued.