On Monday, January 8th, 2024, Kenyan President William Ruto returned to his alma mater, Kamagut Primary School in Uasin Gishu County. The visit, marked by photos shared by Ruto’s handlers, painted a stark picture of a school in dire need of renovation. The building housing kindergarten children, the same one Ruto occupied over 40 years ago, stood as a testament to years of neglect.

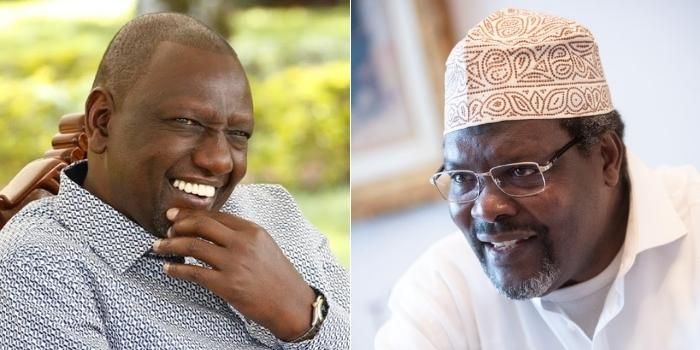

This visit comes amidst Ruto’s ongoing political battle with his rival, Raila Odinga, whom he has severally branded the “Lord of Poverty.” Yet, the state of Kamagut Primary raises a critical question: could the real “Lord of Poverty” be closer to home?

Ruto’s political career spans over two decades, marked by positions of considerable power and influence. He served as an MP, KANU Secretary General, Cabinet Minister, and Deputy President before assuming the presidency in 2022. Throughout his ascent, Kamagut Primary, the very source of his educational foundation, remained in a state of dilapidation.

This begs the question: if someone with Ruto’s resources and political clout couldn’t prioritize the improvement of his own alma mater, how can Kenyans trust him to tackle the broader issue of poverty across the nation?

Furthermore, Ruto’s campaign promises centered around uplifting “Kenyan Hustlers” through initiatives like affordable housing. However, the neglect of Kamagut Primary casts doubt on his ability to deliver on these promises. If basic needs like quality education remain unaddressed in his childhood community, how can Kenyans expect him to effectively address the struggles of millions across the country?

Ruto’s supporters might argue that his recent visit signals a commitment to change. However, the timing, coinciding with a renewed attack on Odinga, raises suspicions of political maneuvering rather than genuine concern for the school’s well-being.

The story of Kamagut Primary transcends a single school. It serves as a powerful symbol of the challenges faced by Kenyan education and exposes the potential hypocrisy of Ruto’s “Lord of Poverty” narrative. Until concrete action is taken to address the needs of Kamagut Primary and countless other schools like it, Ruto’s claims of fighting poverty will ring hollow.

The Kenyan people deserve leaders who prioritize the well-being of their communities, not just political point-scoring. The state of Kamagut Primary serves as a stark reminder that true commitment to alleviating poverty requires action, not just rhetoric. Only time will tell if President Ruto will rise to the challenge and prove his critics wrong.